Bloomberg Technology: OpenAI's Historic Funding Round, AI Dominates VC Deals | Bloomberg Technology

Disclaimer:

This blog post was auto-generated by Accunote AI, aiming to make audio knowledge sharing more accessible. While we strive for accuracy, please note that AI-generated content may contain minor inaccuracies. The original ideas and insights belong to their respective creators: @BloombergTechnology

Industry Overview

AI Development and Impact on Economy

- Masayoshi Son, SoftBank's founder, predicts artificial general intelligence (AGI) arrival within 2-3 years, envisioning AI running entire households, monitoring family health, and handling tasks like grocery shopping. However, MIT economist Darren Acemoglu estimates only about 5% of jobs are likely to be heavily aided or taken over by AI in the next decade, based on current limitations in performing tasks involving physical interaction or complex social interactions. The impact of generative AI on the economy is expected to be gradual, with no dramatic changes like entire occupations disappearing within 5 years due to reliability and reasoning limitations of AI models.

AI Investment Landscape and Venture Capital Trends

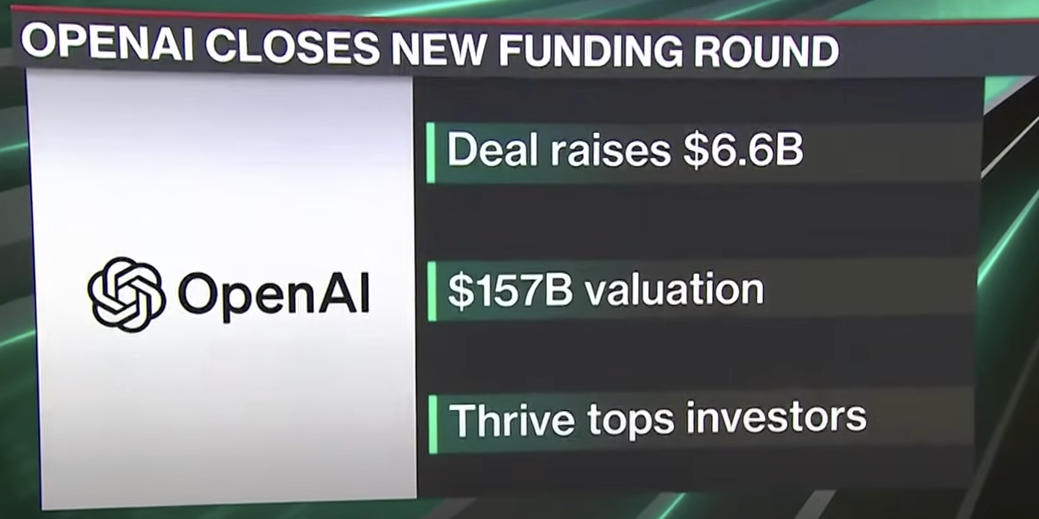

- AI investment is concentrated in San Francisco and the US, with major investors like NVIDIA, Microsoft, Thrive Capital, and SoftBank viewing AI companies as potential sources of huge returns. The recent $6.6 billion OpenAI round will impact 2024 venture capital numbers, but doesn't represent capital availability for the entire market. AI companies are seeing valuations 40% higher than other verticals and larger deal sizes. Venture deal making in Q3 2023 continued at a slow pace, with about $37.5 billion invested in the US, lower than the previous quarter. Outside of AI, there is little excitement in investments, with the slow market evident in exits and fundraising data.

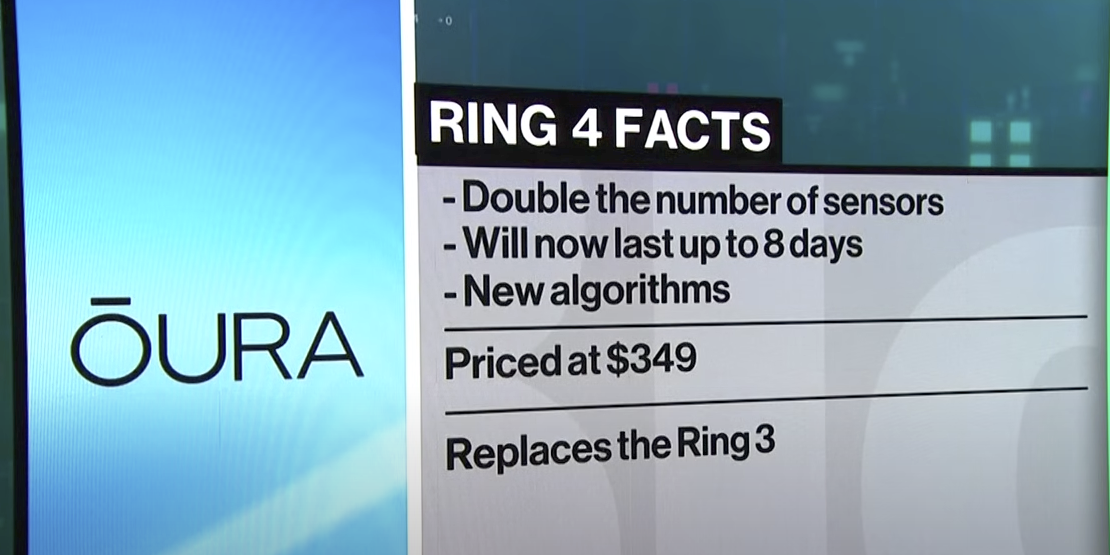

Wearables Market Evolution and Integration

- About two-thirds of Oura users wear a second wearable, usually a smartwatch, indicating complementary use of rings and watches. Rings offer seamless background health tracking and longer battery life, while watches provide notifications and other features. Future potential lies in integrating physiological data from rings with other wearable devices like smart glasses or headphones, enabling rings to act as controllers or provide input on user's stress levels or readiness to other devices.

Semiconductor Supply Chain Challenges

- US-designed chips have been found in Russian missiles despite export controls imposed after Russia's invasion of Ukraine. The complex semiconductor supply chain, involving production in Southeast Asia and numerous middlemen operating through Hong Kong using shell companies, has complicated enforcement of export controls. The US Commerce Department faces challenges in enforcing these controls due to the global nature of the supply chain and multiple layers through which semiconductors are traded before reaching Russia.

Venture Capital Market Dynamics

- The venture capital market is experiencing a slowdown due to limited exits over the past two years, resulting in a large amount of capital stuck in private markets. This situation is expected to continue in coming quarters, as limited partners have no way to recycle cash back into new venture investments. The industry is looking towards 2025 as the potential year for increased exits and distributions, pushed back from earlier expectations of 2023 and 2024. Larger venture capital firms with diverse fund sizes can invest across various stages, from incubation through pre-IPO, allowing flexibility in portfolio construction.

Deep Tech and AI Integration

- Deep tech funds typically have longer investment life cycles, investing in "impossible" technologies with the goal of turning them into "inevitable" successes. AI is intersecting with life sciences, physical intelligence, health tech, and even Medicaid care delivery, creating diverse investment opportunities beyond pure AI plays. Companies need to leverage AI not just for fundraising, but for survival in the current environment, enabling efficiency, better accuracy, and improved profit margins.

Company Landscape

OpenAI

- OpenAI's $157 billion valuation is based on future revenue growth and profitability expectations. The company has secured backing from venture capital firms like Thrive Capital and Khosla Ventures, as well as credit facilities from Goldman Sachs, JPMorgan, Santander, and Wells Fargo. Despite being pre-positive EBITDA, OpenAI obtained a $4 billion credit facility from banks, including European institutions. The company focuses on businesses using their products, particularly fine-tuning models for different workflow parts, with over 1 million business users for ChatGPT and 250 million weekly users across its products.

- Nvidia's nearly $3 trillion valuation reflects growing demand for AI chips, with the company generating revenues to support this valuation. In contrast, an expert is skeptical of OpenAI's $157 billion valuation, stating the company hasn't found a revenue model to justify it yet. While OpenAI's API may become valuable in the future, the expert doesn't foresee applications with deep productivity impacts being sold within 5-10 years. However, OpenAI is emerging as a market leader in the current digital ecosystem. The recent OpenAI funding round included restrictions on investors investing in competitors, a practice some venture capital firms, like Lux Capital, follow to focus resources on existing investments.

Oura

- Oura has launched the Ring 4 with improved features including a slimmer design, enhanced sensors, better battery life, and "smart sensing" that dynamically adjusts to individual physiology. The Ring 4 offers 8-day battery life. Oura Ring sees significant growth potential in the smart ring category as consumers learn about long-term health tracking benefits. The ring can detect illness, provide health insights, and offer AI coaching for behavioral changes. Oura has explored other form factors like lockets and jewelry-style designs, believing there's a big opportunity in helping people manage their health.

Poolside

- Poolside, a startup building AI software for programmers, raised $500 million from investors before releasing its initial product. The funding round, led by Bain Capital Ventures with investments from DST Global, StepStone Group, Citi Ventures, and HSBC Ventures, values Poolside at $3 billion. Waymark, a portfolio company, is leveraging community health workers and AI to predict emergency room admissions and streamline healthcare provider operations in Medicaid communities, demonstrating an effective blend of human-oriented services and AI technology.

Nvidia

- Nvidia insiders have sold over $1.8 billion worth of shares in 2023 as the company's valuation surged. Insiders sold about 11 million shares, the most since 2020 excluding stock splits. While some view the sales with concern, others argue they are normal for wealth creation from stock compensation. Nvidia's stock remains up nearly 150% year-to-date despite being down 9% from its June peak. The investigation found that components from Analog Devices are most frequently discovered on the battlefield, highlighting Russia's dependence on Western technology for guiding missile attacks on Ukraine.

Additional Info

- SAP and Carahsoft are under investigation for potential price fixing, with US prosecutors broadening the probe to cover sales to as many as 94 civilian government agencies.

- SAP produces workforce software such as timecards and HR solutions, while Carahsoft acts as an intermediary in selling to the US government. The ongoing investigation raises questions about these relationships' future.

- A new ETF called DRAG launched, tracking an equal-weighted basket of 9 Chinese tech companies including PDD, Alibaba, Meituan, BYD, and NetEase, with a 0.59% expense ratio.

- Dina Shakir, General Partner at Lux Capital, has released a children's book titled "Lina Moe, CEO", inspired by her experience explaining venture capital to preschoolers.

- Analog Devices stated they consider the use of their components in Russian missiles an illicit diversion of products and do not condone such trade, emphasizing they are not selling directly to Russia.